Success in personal injury law hinges on understanding the numbers behind the cases. Who is filing claims? What types of cases are most common? How long does it take to reach a settlement—and what are those settlements worth? Knowing the answers to these questions can help you make smarter decisions, improve case outcomes, and better serve your clients.

This article breaks down the latest personal injury statistics, giving you a clear view of the current legal landscape. In addition to foundational insights on client demographics, case volumes, average settlements, payment timelines, and lead generation trends, we’ve also included new data on how personal injury firms evolve. You’ll find updated statistics around financial wellness and invoice management, the post-pandemic transformation of legal work, and the growing role of generative AI in legal operations.

Whether you’re refining your firm’s strategy or looking for a competitive edge, these insights will help you navigate the complexities of personal injury law with confidence.

Injury demographic statistics

Knowing the demographics of people who sustain injuries that may require personal injury services can help you shape your firm's marketing and messaging. It also helps you decide where to expand your practice geographically. Let's review age, gender, income, statistics of people who sustained injuries, and location data around personal injury cases.

1. Statistics around age and gender of potential personal injury clients:

In 2023, 148,651 men sustained preventable, injury-related deaths. A total of 74,047 women died from avoidable injuries. The percentage breakdown is 66.8% men and 33.2% women (National Safety Council).

In 2023, more men than women had fatal accidental injuries between birth and age 85. The difference in the number of deaths by gender was most extreme between the mid-20s and mid-60s. At age 86 and beyond, more women died from preventable accidents than men (National Safety Council).

Fatal falls comprised 31.3% of all accidental injury-related deaths for women. The same number for men is 16%.

2. Average income level for potential clients: Limited data available suggests that low-income individuals are more likely to suffer accidental personal injuries. A 2019 review concludes that most studies support a link between low socioeconomic status and childhood injury risk (National Library of Medicine). A 2016 comprehensive study shows a higher prevalence of unintentional injuries in U.S. counties with high poverty rates between 1999 and 2012 (National Library of Medicine).

3. States with the most personal injury cases: Residents of the following five states file the most personal injury lawsuits per 100,000 capita. The data includes filings between March 2022 and March 2023 (Anidjar & Levine Accident Attorneys, quoted by Business Observer).

Florida, with 127.41 cases per capita

Ohio, with 30.38 cases per capita

New Jersey, with 30.34 cases per capita

South Carolina, with 30.12 cases per capita

Illinois, with 22.95 cases per capita

4. Cities with the most personal injury cases: Car wrecks lead to more than half of all personal injuries in the U.S., according to the Law Offices of J.G. Winter. The U.S. cities with the most dangerous driving conditions, per a 2024 report, are below (Forbes Advisor).

Albuquerque, New Mexico

Memphis, Tennessee

Detroit, Michigan

Tucson, Arizona

Kansas City, Missouri

Personal injury industry statistics

The size and growth of personal injury law provide important context for your firm. For example, you can compare your firm's performance on the personal injury statistics below to understand your role within the broader industry.

5. Personal injury law firm market size: In 2023, the market for personal injury lawyers and attorneys was valued at $57 billion, increasing by 1.7% (IBISWorld).

6. Largest personal injury law firms in the U.S. (Law Fuel):

Morgan & Morgan has recovered $25 billion for its clients. The firm markets itself as the largest personal injury law firm in the U.S., with more than 700,000 personal injury cases won (Morgan & Morgan).

Cellino Law has won $2 billion in settlements for clients. Personal injury cases won include a $47 million settlement for a client who sustained permanent brain damage and a $12 million settlement for a client who was left with severe burns. Both cases involved car accidents (Cellino Law).

The Barnes Firm has recent case awards ranging from $300,000 to $3.6 million (The Barnes Firm).

Goldberg, Persky & White P.C. has recently won case awards ranging from $2.2 million to $4.5 million (Goldberg, Persky & White P.C.).

Simmons Hanly Conroy LLC secured history's largest mesothelioma verdict of $250 million (Simmons Hanly Conroy).

7. Number of personal injury lawyers (in the U.S.): In 2023, there were 164,559 personal injury lawyers in the U.S. (IBISWorld).

Personal injury settlement statistics

Personal injury lawsuit statistics vary widely based on settlement type. Claim type is a primary factor influencing settlement amounts, success rates, and case durations. Let's review these personal injury lawsuit statistics for the most common claim types: car accidents, medical malpractice injuries, slip-and-fall incidents, and defective product issues.

Motor vehicle accidents

8. Average case settlement amount for motor vehicle accidents: From a sample of 4,500 cases, law firm Brown & Crouppen estimates the average settlement amount for car accident cases is $37,248.62 (Brown & Crouppen).

9. Average lawyer compensation for motor vehicle accidents: Lawyers charging fees of 30% to 40% of the average settlement amount above would receive compensation of $11,174.59 to $14,913.85 on a car accident case (Price Benowitz).

10. Average insurance payout for motor vehicle cases: In 2022, the average auto liability claim for bodily injury was $26,501 (Insurance Information Institute).

11. Average case duration for motor vehicle cases: Straightforward motor vehicle cases often settle six to nine months after medical treatment is completed. Complex cases can take much longer (Brown & Crouppen).

Medical malpractice claims

12. Average case settlement amount for medical malpractice claims: The National Practitioner Data Bank reports 10,217 medical malpractice payments in 2024, totaling $4.328 billion. That equates to an average payment of $423,607 (National Practitioner Data Bank). However, cases that go to jury trial tend to have larger settlements. For example, the average jury trial award for medical malpractice cases in 2020 was $1.8 million (Insurance Information Institute).

13. Average lawyer compensation for medical malpractice cases: Nolo reports an average medical malpractice attorney fee of 33%. This rate applied to an average payment of $423,607 equals an estimated lawyer compensation of $139,790.31 (Nolo).

14. Success rates for medical malpractice cases: Data on success rates for medical malpractice cases vary. A Nolo survey concludes that 30% of respondents who hired an attorney received an award (Nolo). A report from the American Medical Association indicates that only 25% of cases ended with a settlement (AMA).

15. Average case duration for medical malpractice cases: Medical malpractice cases can take two to three years to settle. Cases that go to trial may take four years or more to resolve (Brown & Crouppen).

Slip-and-fall incidents

16. Average case settlement amount for slip-and-fall accidents: Settlements on slip-and-fall cases can range from $10,000 to $150,000 (CasePeer).

17. Average lawyer compensation for slip-and-fall accidents: Lawyer fees on slip-and-fall cases are usually 25% to 40% of the settlement amount. This implies a total compensation of $2,500 to $60,000, depending on the case complexity and injury severity (Law Offices of Vincent J. Ciecka).

18. Success rates on slip-and-fall accident cases: By one estimate, 95% of slip-and-fall cases settle before going to trial (Smith Law Center).

19. Average case duration for slip-and-fall accidents: Slip-and-fall cases can take three to 18 months to resolve (Smith Law Center).

Product liability cases

20. Average case settlement amount for product liability cases: Product liability cases have the highest personal injury settlement statistics. Considering product liability cases that went to jury trial in 2020, the average settlement award was about $7 million (Insurance Information Institute). Cases settled before trial produce smaller settlements, from $10,000 to $500,000, depending on injury severity (CasePeer).

21. Average lawyer compensation for product liability cases: Defense costs in product liability cases averaged $869,370 in 2023 (Insurance Information Institute).

22. Success rates on product liability cases: Roughly two-thirds of product liability cases end with a settlement for the plaintiff (Lex Machina, quoted by Insurance Canopy).

23. Average case duration for product liability cases: Product liability can be resolved in one to three years. Cases that go to trial take the longest, with an average of 886 days for the case to reach the trial phase (Lex Machina, quoted by Insurance Canopy).

Personal injury practice management statistics

Running a personal injury firm isn’t just about winning cases—it’s about managing a complex, high-volume business. From lead intake and case tracking to expense management and billing cycles, operational efficiency plays a critical role in profitability.

This section combines data from the 8am MyCase Benchmark Report 2024 and the 2025 Legal Industry Report: Personal Injury Insights to give you a holistic view of how personal injury law firms are managing the business of law. You’ll find insights on everything from payment timelines and accounting tools to expense categorization and trust account compliance.

Financial statistics

How does your personal injury firm stack up on expense management, payment timelines, and accounting tools? See how your practice compares to industry benchmarks.

24. Average number of expenses for personal injury cases: Personal injury lawyers record an average of 181,064 expenses. This ranks among the highest of practice areas, above trust and estate attorneys and real estate lawyers (MyCase 2024 Benchmark Report Part 1: Law Firm Finances).

25. Average expenses per personal injury case: Every personal injury case incurs 4.1 expense types on average, indicating a costly and complex case management process. For context, family law cases incur 3.7 expense types, and criminal law cases incur just 2.8 expense types (MyCase 2024 Benchmark Report Part 1: Law Firm Finances).

26. Personal injury law firm time to payment: Personal injury firms take 184 days on average to get paid. This is the longest first payment timeline across practice areas and a function of contingency-based fee structures (MyCase Benchmark Report Part 2: Getting Clients).

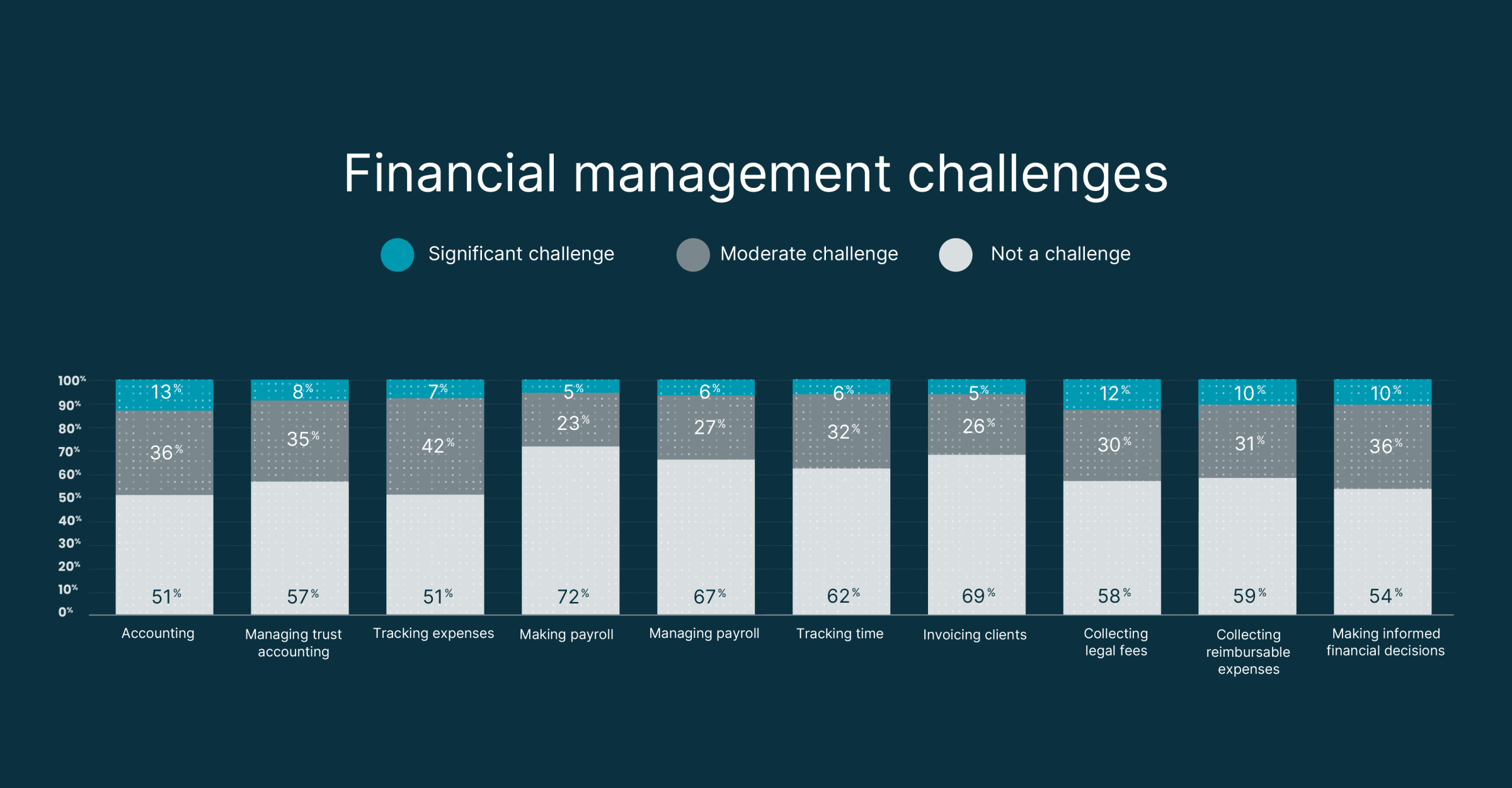

27. Accounting challenges remain significant: Nearly half of personal injury professionals (49%) identified accounting as a significant or moderate hurdle for their firms, highlighting persistent inefficiencies in managing financial records compared to the overall legal market (2025 Legal Industry Report: Personal Injury Insights).

28. Expense tracking and reimbursement slow firms down: Managing expenses (49%) and collecting reimbursable costs (41%) were cited as ongoing challenges for personal injury firms, pointing to areas where automation could improve profitability (2025 Legal Industry Report: Personal Injury Insights).

29. Getting paid continues to be a struggle: Fee collection remains difficult, with 42% of personal injury firms reporting challenges in receiving timely payments—an issue that directly impacts cash flow and financial stability (2025 Legal Industry Report: Personal Injury Insights).

30. Top three expense categories for personal injury:

Medical records are the largest expense category.

Postage and document handling come in second.

Unspecified expenses rank third—revealing a major opportunity to improve expense categorization and reporting accuracy (MyCase 2024 Benchmark Report Part 1: Law Firm Finances).

Client and lead statistics

31. Average lead conversion time: Personal injury firms have the fastest lead conversion time across practice areas. On average, personal injury firms convert leads into clients in three days (MyCase Benchmark Report Part 2: Getting Clients).

32. Number of leads generated: In 2023, surveyed personal injury firms generated 36,255 leads, producing 2,559 consultations (MyCase Benchmark Report Part 2: Getting Clients).

33. Rate of consultations set from leads: Just 7% of personal injury firm leads set consultation appointments. This is the lowest across practice areas. The average across all practice areas is 14%. Trust and estate attorneys make the most of their leads, setting consultations for 27% of them (MyCase Benchmark Report Part 2: Getting Clients).

Generative AI adoption statistics

Personal injury lawyers are at the forefront of generative AI adoption in legal. Firms are embracing AI tools not just for efficiency, but to strengthen case outcomes and client service. The latest data highlights how they are leading the AI charge:

34. Individual AI use is growing: 37% of personal injury professionals report personally using generative AI for work-related purposes—higher than the legal industry overall (31%) (2025 Legal Industry Report: Personal Injury Insights).

35. Firmwide AI adoption is underway: 19% of PI firms have already implemented legal-specific AI tools, with another 16% planning to adopt them by fall 2025 (2025 Legal Industry Report: Personal Injury Insights).

36. Top AI use cases: Among those using AI, the most common tasks include drafting correspondence (52%), brainstorming ideas (46%), drafting documents (39%), and summarizing records or depositions (2025 Legal Industry Report: Personal Injury Insights).

37. Time savings are clear but varied: 29% of firms using AI report saving 1–5 hours per week, while a smaller group (2%) save 6–10 hours or more, showing the technology’s efficiency potential (2025 Legal Industry Report: Personal Injury Insights).

38. Expected benefits from future AI adoption: Looking ahead, 61% of firms anticipate AI will increase overall productivity, 44% expect cost savings, and 36% believe it will replace some administrative functions (2025 Legal Industry Report: Personal Injury Insights).

39. Priorities for legal-specific AI tools: The most in-demand AI capability is summarizing and analyzing medical records (56%), followed by analysis of lengthy documents like trial transcripts (48%) and automated brief drafting with cite-checking (34%) (2025 Legal Industry Report: Personal Injury Insights).

Explore the rise of AI legal brief writing software or learn more about our legal AI tools.

Statistics highlighting the impact of COVID-19 on personal injury law

The COVID-19 pandemic permanently changed the way personal injury law firms operate. From remote work to client interactions and courtroom proceedings, firms have adapted to new expectations and technologies. Here’s how the landscape looks today:

40. Widespread adoption of remote tools: 71% of personal injury firms now use cloud-based technologies for remote work, including e-signature (89%), e-filing (76%), and video conferencing (75%) (2025 Legal Industry Report: Personal Injury Insights).

41. Changing office arrangements: 39% of PI firms still require full-time in-office work for all staff, but hybrid models are becoming more common, with 28% of firms offering at least partial flexibility (2025 Legal Industry Report: Personal Injury Insights).

42. Virtual court is now the norm: 82% of personal injury professionals have attended proceedings remotely, with 24% doing so weekly (2025 Legal Industry Report: Personal Injury Insights).

43. Client comfort with virtual meetings: 38% of firms report their clients are now comfortable with video conferencing, showing a lasting shift in client expectations since the pandemic (2025 Legal Industry Report: Personal Injury Insights).

44. Preference for in-person trials and depositions: Despite virtual adoption, 56% of PI attorneys prefer jury trials in person, and 49% prefer depositions in person—highlighting where face-to-face interaction is still considered essential (2025 Legal Industry Report: Personal Injury Insights).

45. Security remains the top concern in remote work: 61% of firms cite data privacy and confidentiality as their primary challenge with remote work, followed closely by cybersecurity risks at 57% (2025 Legal Industry Report: Personal Injury Insights.

How 8am CasePeer supports personal injury lawyers

At 8am™ CasePeer, we help personal injury firms streamline every part of their practice with software designed for their specific needs:

Financial management: From expense tracking to trust accounting, CasePeer simplifies financial oversight so you can spend less time reconciling and more time closing cases.

Legal AI tools: CasePeer's integrated AI tools help firms summarize documents, organize medical records, and draft key documents faster.

Streamlined case management: Automate task workflows, set critical reminders, and keep every document in one secure place.

Enhanced client communication: With built-in text and email messaging, keep your clients informed.

Give your team the tools they need to win more cases and deliver better outcomes for every client. Schedule a CasePeer demo today.

About the author

Catherine Brock is a financial and fashion writer who’s been featured on BBC News, USA Today, MSN Money, Fox2 St. Louis, ABC7 Chicago, CBS2 Los Angeles, WGN Chicago, and WCPO Cincinnati. She also contributes regularly to Forbes.com and Yahoo Personal Finance. When she’s not picking top stocks, sharing budgeting advice, or shopping for clothes, you can find her riding a horse in the countryside.